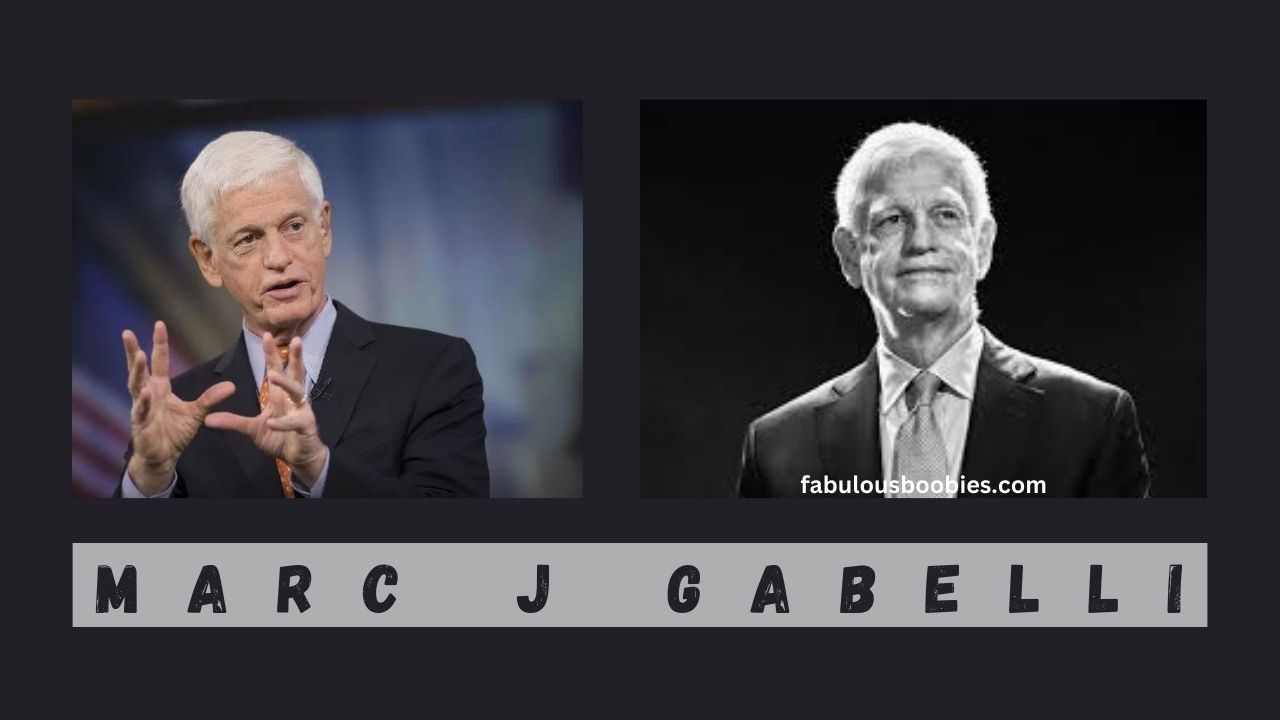

Marc J Gabelli is a name that resonates in the world of finance, known for his brilliance in investments and his ability to navigate complex financial markets. As a prominent investor, businessman, and philanthropist, his impact on the industry is undeniable. His journey in the financial world has shaped his career and the investment landscape, influencing countless other investors and businesses. This article will explore the life, career, and philosophy of Marc J Gabelli, shedding light on his contributions to the financial industry and his lasting legacy.

Early Life and Educational Background

Marc J Gabelli was born into a family with a strong business connection, which undoubtedly shaped his early interests and ambitions. From a young age, Marc displayed a keen interest in business and economics. His intellectual curiosity and desire to understand the dynamics of finance were evident early on, and he pursued these interests in his academic endeavors.

Gabelli attended Columbia University, one of the leading institutions for finance and economics, where he studied under some of the finest minds in the field. Columbia, known for its rigorous academic programs, provided Gabelli with a solid foundation in economic theory, financial analysis, and investment strategies. During his time there, Gabelli was exposed to some of the most influential works in the field of finance, particularly those related to value investing—a strategy that would later become central to his career.

After earning his degree, Marc J Gabelli embarked on a professional journey that would eventually lead him to become one of the most influential figures in the world of finance. His academic training laid the groundwork for his ability to think critically, analyze markets, and develop investment strategies that would become his hallmark.

The Early Stages of His Career

After graduating from Columbia University, Marc J Gabelli began his professional career in finance, gaining experience in various positions within investment firms. His early work in the field helped him hone his skills and provided him with a deeper understanding of financial markets, corporate structures, and investment strategies. Gabelli’s first professional steps were marked by a commitment to learning, as he spent countless hours analyzing financial statements and developing models for predicting market trends.

During the 1970s and 1980s, Gabelli’s career gained momentum as he worked in several prominent firms, where he developed the expertise that would ultimately help him achieve significant success. One of the key factors that set Gabelli apart from his peers was his ability to identify undervalued assets—an approach that would form the foundation of his investment philosophy. He recognized that financial markets often mispriced companies, and by identifying these mispricings, he could profit while helping these companies unlock their full potential.

It wasn’t long before Marc J Gabelli decided to take his career to the next level by founding his investment firm, Gabelli Asset Management. His decision to establish the firm was driven by a desire to have more control over the investment process and a belief in the long-term success of value investing. This would prove to be a pivotal moment in his career, as Gabelli Asset Management would go on to become one of the most respected and successful firms in the investment world.

Founding Gabelli Asset Management

In the 1980s, Marc J Gabelli took a bold step by founding Gabelli Asset Management, a company that would grow to manage billions of dollars in assets. The firm’s strategy focused on long-term value investing, which is grounded in the belief that the market often undervalues companies. Gabelli sought to identify opportunities where he could invest in companies with strong potential for growth that had not yet been recognized by the broader market.

Gabelli’s strategy was based on a comprehensive approach to analyzing businesses. Rather than focusing on short-term market fluctuations, he took a deep, fundamental approach to assessing companies. This included evaluating financial statements, management teams, market conditions, and long-term business prospects. Gabelli Asset Management was built on this philosophy, and the firm became known for its ability to identify undervalued stocks and create a diversified investment portfolio.

One of the hallmarks of Gabelli Asset Management’s success was its focus on producing value for its clients over the long term. Gabelli’s expertise in financial analysis allowed him to make informed decisions about where to allocate capital, leading to impressive returns for investors. Over the years, Gabelli Asset Management gained a reputation as one of the premier investment firms in the world, attracting a wide range of institutional and individual clients.

The Investment Philosophy of Marc J Gabelli

Marc J Gabelli is best known for his distinct investment philosophy, which revolves around value investing. This strategy, which he honed throughout his career, focuses on finding companies that are undervalued relative to their intrinsic worth. Gabelli believes that the market does not always accurately price companies, which creates opportunities for savvy investors who can identify these mispriced assets.

Gabelli’s approach to investing is rooted in several key principles:

- Long-Term Focus: Gabelli’s philosophy emphasizes the importance of long-term investment horizons. Rather than seeking quick gains or short-term profits, Gabelli focuses on investments that offer strong growth potential over many years. This approach requires patience, but it has proven to be highly effective in delivering substantial returns over time.

- Fundamental Analysis: Central to Gabelli’s approach is the belief in thorough and diligent research. Before making any investment, Gabelli and his team conduct in-depth analyses of a company’s financial health, management team, market position, and overall business model. This attention to detail ensures that Gabelli is investing in companies with strong potential.

- Contrarian Thinking: Gabelli has often emphasized the value of thinking differently from the crowd. He is willing to invest in companies that others may overlook, particularly those that are temporarily out of favor with the market. By doing so, he has been able to uncover opportunities that other investors may miss.

- Diversification: Although Gabelli’s strategy is grounded in value investing, he is also a proponent of diversification. He believes that a well-diversified portfolio mitigates risk and provides a balanced approach to managing investments across different sectors and industries.

- Emphasis on Management: Another critical component of Gabelli’s investment philosophy is his focus on the quality of a company’s management team. Gabelli believes that strong, visionary leadership is one of the most important factors in determining a company’s long-term success. He looks for businesses led by individuals with a proven track record of making smart decisions and driving growth.

Marc J Gabelli’s investment philosophy has been instrumental in the success of Gabelli Asset Management. The firm’s ability to consistently identify undervalued companies and generate long-term value for its clients has made it one of the most respected names in the investment world.

Gabelli’s Contribution to the Financial Industry

Marc J Gabelli’s impact on the financial industry extends far beyond his success. Through his work at Gabelli Asset Management, he has shaped the way that investors approach the markets. His emphasis on value investing has led many investors to adopt similar strategies, and his methods for analyzing companies have been widely studied and emulated.

Gabelli’s success has also had a broader impact on the industries and sectors in which he has invested. By identifying undervalued companies, Gabelli has played a role in helping these businesses unlock their full potential. Many of the companies that Gabelli has invested in have experienced significant growth, which in turn has driven innovation and development in various industries.

Moreover, Marc J Gabelli’s leadership at Gabelli Asset Management has set a standard for excellence in the investment industry. The firm’s focus on thorough research, diversification, and long-term value has become a model for other investment firms to follow. Gabelli has shown that success in the financial world requires not only skill and knowledge but also integrity, discipline, and a long-term perspective.

Philanthropy and Personal Legacy

In addition to his achievements in the financial world, Marc J Gabelli is also known for his philanthropic efforts. He has donated to numerous charitable causes and institutions, including education, healthcare, and the arts. Gabelli’s commitment to giving back is reflected in his support for organizations that align with his values and interests.

Marc J Gabelli’s legacy extends beyond his financial accomplishments. His impact on the world of finance, combined with his dedication to philanthropy, has cemented his place as one of the most influential figures of his generation. His work continues to inspire future generations of investors and business leaders who aim to follow in his footsteps and create lasting success.

Conclusion

Marc J Gabelli’s career is a testament to the power of vision, discipline, and strategic thinking. Through his work at Gabelli Asset Management, he has proven that a focus on value investing, long-term growth, and thorough research can lead to tremendous success. His contributions to the financial industry have shaped the way investors approach the markets, and his legacy continues to influence the world of finance today.

Gabelli’s story is one of perseverance, innovation, and commitment to creating lasting value. He has demonstrated that by staying true to one’s principles and consistently making informed, thoughtful decisions, it is possible to achieve lasting success in the world of finance. Marc J Gabelli’s journey serves as an inspiration to anyone seeking to make a difference in their chosen field, and his impact on the financial industry will be felt for generations to come.